Full Associate

- #15

I think there can be specific text about loan one states “if you believe like you don’t want to spend so it right back will ultimately, be at liberty to not.”

I have to state it thread is beyond ridiculous. It may sound just like your woman will not works. ) to expend all of them right back.

It may sound as if you men have previously didn’t spend the loan money back and are usually simply asking for recognition or “what’s the bad that may takes place.” thumbdown Sorry one to repaying financing is getting about way of your lifetime. I can’t believe this is exactly an authentic bond.

We consent, and we also have already discussed the fresh prenup, and you can this lady has agreed to it, so i am considering it must not be as well mundane.

You guys create good section, it could well be easy for their to pay off in the americash loans Kiowa event the she’s got a career at an effective starbucks or something like that and that is able to throw each of her earnings at personal debt, although problem is one she is inside forebearance today, that’ll merely past 3 years, and i have been in my personal second 12 months away from home whenever brand new forebearance expires, and i dont see how she will be able to put every one of their unique earnings within obligations as soon as we are sub-standard. Including, attract was accruing throughout forebearance, therefore the loans would-be worse. I want to possess her to end defaulting toward loan preferably, but Really don’t find a means at this time ‘s the state.

Enough time Live brand new Tissue!

- #17

. and when your own moral compass is still so from harmony that everyone else’s arguments regarding why you ought to maintain your (both) borrowing clean, there are some a lot more boring reasons to take action:

Full Affiliate

- #18

idea would be to place your coming house and other assets in your label merely so that they cannot be affixed.

products produced listed here are a as a whole, I’m writing since the a person with a partner w/highest student loans, as well. The issue that is missed ‘s the truth regarding exactly how nothing you can get get hold of spend since a physician after taxes. Say you are a primary care and attention physician 170,000 annually payment on your own behavior, staying in a state w/5% county taxation, step one child that mate remains where you can find check out.

170,000 earnings (16,000) social coverage – fifteen.2% toward very first 106K in addition to employee/employer “contribution”, (8,000) county tax (5% from 162K – no tax to your “employer” soc. sec share) (thirty two,400) given income tax – projected overall income tax rates was 20%, it depends into write-offs (37,000) education loan efforts – this can include 200K med scholar + 100K mate student loan, mate loan has expanded so you can 155K by the season eight if it begins to be paid straight back.

Pull out 2 normal car and truck loans (550 for every four weeks) and you will good 300K home loan, around the mediocre value of property a number of region parts, and you’re remaining w/3K monthly for utilities, dinner, insurance rates, energy, phone, cord, an such like.

And that ount, but that it assumes on zero $$ put aside to have kids’ school, pension, holidays, students school if one beliefs private knowledge.

And after that you start to think.. wait one minute, I am spending really high taxes once the I’m rich. But I am not saying steeped while the I have to pay-off these types of funds to your bodies, the exact same entity that is meeting the newest taxation. And I’m make payment on fees partly to simply help other people with many different public software that I’ll most likely never fool around with, while the I has worked so very hard to track down courtesy med college or university to possess too many years. And you will public stress seems to suggest taxation costs on the “brand new steeped” might possibly be going up, in the event 38% of houses haven’t any government income tax responsibility today so actually my 3K 30 days left will likely go lower.

]]>In general, you need to expect to pay ranging from 0.5% and step one.5% of your own overall loan amount annually. It ends up to $125-$375 a month.

Such prices usually usually are nevertheless an identical during your financial insurance coverage costs. Yet not, multiple things can raise otherwise reduce the overall commission you’ll shell out annually in mortgage insurance fees.

The following situations is also dictate your own annual requisite mortgage insurance payments, impacting just how much you’ll pay four weeks getting PMI:

Private mortgage insurance rates payments can differ notably based on your unique products

- Your own home mortgage size: One of many deciding affairs in your mortgage insurance’s rates ‘s the complete loan amount. The larger the loan was, the more your own monthly financial premium might possibly be. Hence, it is important to stand inside a fair finances centered on their earnings and you may money.

- The brand new downpayment proportions: Because one of the primary issues into the determining your monthly PMI costs ‘s the size of their mortgage, among the many ideal a method to lower your superior is always to improve size of your down-payment. Even if your own financing will not assistance putting a complete 20% off from the closing, you could potentially spend whenever you can upfront to prevent expensive PMI money.

- Your credit score: A different edd card info crucial adding basis toward month-to-month PMI superior can be your credit rating. It part is very important to remember as you may have a higher credit score even though you don’t have a lot of dollars. Strengthening good borrowing from the bank habits throughout the years will save you thousands away from cash fundamentally for the mortgage insurance policies.

- The kind of mortgage you really have: Different varieties of money can also be dictate their PMI price. Such as, into the a conventional home loan given of the a bank, your I than you’ll into a federal Houses Administration (FHA) mortgage. Simply because FHA loans are made to fit basic-day homeowners and other people with low-to-reasonable earnings profile.

- Assets love possible: While thinking of moving a place where home prices is actually appreciating, you I advanced. When your home’s really worth grows enough, you can also avoid PMI costs totally. It’s possible to have your property appraised once more, assuming the significance enjoys grown over 20%, you can demand the newest cancellation of your own PMI.

Do PMI Drop off Throughout the years?

Your financial insurance rates rates will usually be consistent through your costs. not, if you find yourself eager to spend less on monthly installments and you can terminate their PMI early, you can find methods decrease your home loan insurance fees.

Private financial insurance coverage money may vary significantly dependent on your unique facts

- Make use of finally cancellation: Your own financial is oftentimes necessary to stop PMI immediately after you have attained the halfway section of the loan’s amortization agenda, no matter how much security you obtained. It means if you have an excellent 40-year loan, your bank often cancel your own financial insurance once two decades as a lot of time because the you’re latest in your payments.

- Arrive at guarantee out of 80% or more: In the event the equity is at 20% or higher of one’s unique worth of, you have the to consult that bank terminate your own mortgage insurance. For those who have additional money, making a lot more repayments is a sure way to help you free yourself out of PMI faster. If you are up-to-go out into payments, the financial institution will be cancel your PMI when you very own 20% when you look at the security.

- Refinance your financial: If you notice a drop during the financial pricing, you could consider refinancing your own mortgage to attenuate the monthly payments and you can save money on appeal will set you back. This course of action you can expect to allow you to cure your own PMI should your the fresh financial was lower than 80% of residence’s worth. Just before investing refinancing, make sure to consider added settlement costs so that the exchange is actually worthwhile.

Tips All the way down Vendor Closing costs

When you find yourself a provider who wants to save money in the home purchases procedure, the best option is to look for an effective way to clean out Agent fees. Such deals enables that put down a larger down fee on the second household or can help security swinging will cost you.

The original means to fix safe straight down Real estate agent commissions will be to satisfy having multiple representatives before you could get one. Prepare some issues to satisfy the new Real estate professional together with expenses associated with with them. Learn which agents are cheaper to hire incase you will lose people services as a result of this value.

While you are offering in the a trending industry in which you predict to find multiple people, thought choosing an apartment-percentage representative. This type of Real estate professionals make bundles from characteristics and costs an apartment pricing to them. You do not keeps a real estate agent toward-call particularly an elementary, commission-mainly based Real estate agent, however you will spend less. Remember that you continue to need to pay the newest buyer’s agent its questioned payday loan Williamsburg percentage.

You can explore a service like UpNest to keep. We works together with Real estate professionals to provide offers on the earnings. After you hire an UpNest circle representative, you can enjoy the caliber of handling a highly-rated Realtor without having to pay significant charge.

Do you discuss closing costs?

There was a different way to lower your Illinois settlement costs inside acquisition to save cash. You are able to make settlement costs on the discussion techniques so your buyer otherwise provider pays a lot more of these fees.

If you find yourself entering a customer’s market, where suppliers lack of many now offers on the land as directory was high, envision inquiring a supplier to blow a number of your own closing costs. This type of gets pulled about latest sale of the house and certainly will make it easier to safety your house insurance rates, write off factors, and software fees.

When you find yourself typing a beneficial seller’s sector, where for each and every listing receives numerous estimates on account of low list, next sellers can be inquire buyers to fund some of the fee costs. In many cases, this is often a better option than just accepting an overhead-markets provide.

From inside the 2022, the business favors suppliers. Index try lowest and people should make the has the benefit of remain out. It could be burdensome for people making requires away from sellers, when you are sellers may innovative which have how they negotiate having customers.

Discover a keen Illinois Agent that have UpNest

If you are considering buying or selling property into the Illinois, run the professionals in the UpNest. I have examined countless Realtors regarding along the state and have selected an educated of those for the recommendation engine. In lieu of filtering through plenty of users, find a number of top quality agencies who will be suitable for your circumstances.

Working with UpNest may also help decrease your Illinois closing costs. Our very own consumers save your self $step 3,743 during the Real estate professional commissions typically. Is our free solution now and take the initial methods so you can save your self.

People when you look at the Illinois that are looking to purchase or sell the belongings should expect to blow all the way down settlement costs typically than just all of those other country. For the reason that away from straight down taxation rates, less fees, and lower assets thinking as compared to other states. Settlement costs is going to be highest in some components, though, particularly il.

The town from il Transfer Tax is imposed toward people whom is getting into the city. They will cost you 0.75 % of your own purchase price of the house. You are able to look at it because the $3.75 for every $five hundred you may spend. If you purchase good $five-hundred,000 home, then you may expect to pay $3,750 to cover that it tax.

]]>It’s usually quite difficult to really get your title of home financing immediately after separation, and you will require the assistance of him or her, however it is nonetheless a significant step when deciding to take. Luckily, you have got several options. Four ways to get your own term from your property home loan are

- Re-finance our cash advance Pleasant Grove AL home

- Make an application for financing presumption

- FHA improve re-finance

- Sell our house

- Pay off the loan

All these strategies will additionally benefit providing your own title off of the loan away from accommodations otherwise investment property.

One of the most preferred ways to get their identity out-of the borrowed funds immediately following split up should be to have your ex-lover refinance the borrowed funds. It indicates, generally, taking out another financial and making use of that money to invest off of the old home loan balance.

If you’ve oriented adequate collateral in the house, him or her-spouse may be able to require some of this money out due to a profit-away refinance and you can shell out your straight back your own show of collateral in the house.

To begin with the whole process of removing your label throughout the mortgage because of a good refinance, its vital to discuss openly and you will work with your ex-mate. To one another, you’ll need to get a hold of a lender who is prepared to approve the brand new refinancing software centered on your ex lover-partner’s financial predicament. This typically comes to a credit score assessment, earnings verification, and good reassessment of your own property’s really worth.

Qualifying getting a great refinance can be burdensome for many recently unmarried somebody. Him/her should show the lending company that they’re financially capable of handling the loan themselves without having any help of your revenue. In the event your spouse brings in lower than you, they aren’t acknowledged for the the brand new loan.

Additionally, if rates of interest has risen as you got out your financial, him or her-wife or husband’s the fresh mortgage payment was notably large.

Have your Ex lover-Partner Imagine Your existing Home loan

Rather than refinance or take towards the a whole new mortgage, your ex lover-mate can be alternatively just assume your mortgage in their own label. Very first, it is vital to look at the regards to their brand-new mortgage agreement to decide in the event that presumption are welcome. In the event that loan assumption are allowed, your partner will need to pertain and you can qualify for the assumption.

In many ways, qualifying to visualize a current mortgage is much like being qualified to possess an excellent re-finance. The financial institution will need economic recommendations, also proof of income, credit score, or other related economic data files. Him/her can also need certainly to give a duplicate of your own split up decree otherwise settlement arrangement, and therefore contours new distribution away from assets and liabilities, such as the presumption of one’s mortgage.

In essence, your ex-spouse will need to reveal that they have the fresh economic capability to handle the loan by themselves. It could be hard for a newly divorced personal to visualize an interest rate. Many mortgage brokers should not change financing out of a few men and women to you to definitely that will increase the financial chance.

On top of that, in case your ex-mate takes on your existing mortgage, they will not manage to capture funds from your house so you can fork out their part of the security. On the reverse side of one’s coin, if you were in a position to protected low interest towards the your new financing, and when the borrowed funds will keep home loan repayments down for your ex lover.

Have your Companion Consult an FHA Improve Re-finance

The fresh FHA improve refinance choice is designed for people who have an FHA-backed home loan. That is, essentially, a good refinance of one’s financial but with great features. A keen FHA streamline re-finance needs smaller documents than a timeless re-finance. Permits him/her to eliminate your because the an effective co-borrower that can actually all the way down the mortgage payment. Decreased payments is an enormous benefit proper transitioning to make payment on loan with only you to definitely income.

]]>Extremely lenders wouldn’t leave you home financing when you have unfiled tax statements, but it might be you can easily if you use a choice financial. Basically, the most suitable choice would be to file your tax returns, create fee plans to your unpaid taxes, and possess income tax liens eliminated earlier the mortgage process. To assist you, this article explains as to why really mortgage lenders need tax returns, choices for taking a loan as opposed to tax statements, and you may what to do if you have unfiled production and need to shop for property.

- Mortgage brokers have fun with taxation statements to verify your earnings.

- You simply can’t score FHA, USDA, Va, otherwise Federal national mortgage association/Freddy Mac finance in place of an income tax go back.

- Some option loan providers will get assist you – anticipate highest down repayments and higher interest rates.

- For the best mortgage terms, file dated taxation statements before you apply having home financing.

- Making installment payments in your income tax loans cannot end your of getting home financing.

Why Mortgage lenders Ask for Your own Income tax Come back

Home financing ‘s the most significant mortgage a lot of people will ever capture out, and your lender should end up being positive that you could pay which high amount of cash. To learn about your financial situation, the lender talks about your proof earnings, tax returns for the last couple of years, credit history, or any other financial records.

You could posting the taxation statements right to the lender, otherwise they might use the Income Verification Show Provider to locate your details from the Irs. If you’re unable to give this particular article, extremely lenders would not approve your financial software.

Underwriting Laws and regulations getting for most Mortgages

Almost all (70%) from mortgage loans in the us is underwritten because of the Fannie Mae otherwise Freddie Mac computer. You need to provide a taxation go back to obtain possibly ones fund, but when you pertain ranging from April and you may October, you’re able to use past year’s tax return due to the fact long as you have proof you submitted an extension and you can paid one estimated every quarter income tax towards the seasons. The brand new Federal Homes Administration (FHA), the usa Service regarding Farming (USDA), therefore the Agencies regarding Veteran Factors (VA) provide government-recognized funds having loose monetary requirements than simply antique mortgages, but these financing require also taxation statements.

Mortgage loans You can get Versus an income tax Get back

An incredibly brief a small number of loan providers tends to be ready to bring your a no-tax-go back home loan which is possibly known as a zero-doc or reasonable-doctor financial. Sometimes they belong to another several groups:

Organization No Income tax Return Lenders – These businesses bring a close look at your earnings data and you may your finances comments. Because they work on high-risk subscribers, they typically costs high rates than other lenders. If you get a zero-tax-get back mortgage, you ought to expect to pay 10 so you’re able to 20% or maybe more once the a down payment.

Asset-Mainly based Mortgage loans – For those who have a good amount of close-quick assets (low-exposure carries, bonds, etc), you happen to be able to get home financing based on the worth of your assets. These finance are sometimes named resource destruction funds. The borrowed funds is initiated because if their yearly income try the total of one’s possessions divided because of the label of your own financing. Instance, when you have $1 million, that compatible $50,000 a-year more good 20-12 months mortgage.

Owner-Carry Mortgage lenders – That is where you create payments directly to the owner. Mainly because loans is actually treated ranging from anyone, they don’t have a comparable stringent conditions once the old-fashioned mortgages. Owner-bring money they can be handy in some situations but risky otherwise also predatory in other people payday loan Perdido Beach. Keep in mind that of numerous holder-hold arrangements include a great balloon percentage.

]]>The latest Chi town Social Shelter Manager House Consumer Guidance System is a great airplane pilot system which was created to improve struggling areas by the encouraging police force to shop for property in those groups. Eligible law enforcement officers whom meet the maximum money standards found $30,000 to support deposit and you will closing costs.

100 % free 12 months domestic promise (up to $350 worth)*** The police Home loans Your risk yourself every single day. We need to inform you money loans in Fort Deposit our very own like through getting you in to the home of your fantasies. If you find yourself in law administration during the Oregon, then you certainly qualify for the Loans to possess Oregon Heroes system and you will the pros that come with they. Pick Any household in the business Offers around $8, (In which readily available) Down-payment Recommendations up to $ten, Home loans to own very first time homebuyers. Popular rates of interest Free assessment (to.

Fl Congressmen Need New house Financing Program getting Laws.

All of our very first responder mortgages give earliest responders, in addition to firefighters and you may paramedics, for the reasonable financing they should get or re-finance a great domestic. We’re serious about trying to repay the newest heroes that have over so much in regards to our organizations. Our team within Hero Home Programs works with earliest responders to obtain all of them the recommendations. Law enforcement Can save Towards the A property – Purchase | Offer | Refinance I Let Law enforcement Spend less on a property For instance the lion, your stay observe securing and offering the communities, staying the fresh tranquility, strolling this new thin bluish range. I have your back if you want to get back of against the fresh new risks and you may demands within our organizations each day.

Firefighter, Law enforcement Lenders: Champion Home loan.

Whether you’re interested in a great firefighter or law enforcement house loans i have one another and more! Follow; Follow; Follow; Follow; Customer’s Portal. 303-384-3207. The team. This new Helper Work is designed to fight this situation, providing an alternate, sensible financing solution according to the Federal Homes Administration. How the Helper Operate works Assistant Operate mortgage loans is suitable far. Lenders Having Police – If you are looking to own in check solutions right from the start, next the solution is a superb selection. Home loans Having Law enforcement officers ?? Starting a volatile community come on independent screen which have negligence off inaction. rfnneietd cuatro.9stars -1595reviews.

Mortgage brokers for Police officers inside Tx – TSAHC.

Law enforcement officials within the country will get the second gurus that have FHA lenders: Reduced down money FHA home loans require an inferior down-payment than the traditional mortgage brokers. Borrowers pay just step 3.5%-10% of its total mortgage as his or her deposit. Its ideal that you set-out 20% while using the a traditional financing. The authorities Home loans Done right Basic facts, Stability, Worthy of And you can… $0.00 Bank Costs* to have LEOs Periodically people that cover and you may serve have to be secure. Your house Finance To have Nurses Program which have Heroes House Virtue Domestic loans to own nurses program. Weight Much more HHA try a real estate discount program of these one protect, suffice and you can look after our very own nation and you can community: military, the police, firefighters, medical care, crisis employees and you will instructors.

Heroes Family Virtue.

If you are an individual which have disabilities exactly who means holiday accommodation, or if you are experiencing difficulty using the web site to apply for that loan, delight call us within 888-450-Flame (3473) This contact info is actually for rooms demands only. Such as for instance, doing 5.5% from inside the DPA is available in combination with a traditional, FHA, Virtual assistant otherwise USDA 31-year repaired-price mortgage through the GSFA Rare metal Program. To estimate the latest DPA into the dollars, proliferate new DPA fee (1) of the First-mortgage Amount borrowed. Therefore, 5.5% DPA to your a $five-hundred,000 loan amount = $twenty seven,five hundred (five-hundred,000 x.055). Law enforcement Home loan Software Get up in order to $eight hundred Assessment Borrowing Back at the Closure. I help policemen and you can feminine or any other law enforcement gurus.

]]>- IFC’s earliest resource serious about supporting Ukrainian Artificially Displaced Persons (FDPs)

Madrid, Spain, -IFC are partnering having Santander Bank Polska S.An excellent. (SPL) in order to release its very first financial support geared towards helping Ukrainian Artificially Displaced People (FDPs) in addition to Ukrainian FDP-owned and you will FDP-comprehensive small businesses for the Poland.

IFC is offering as much as $17 mil as the one minute-losings ensure getting individual finance from the SPL. That will enable the financial institution to take back funding and you will material about $100 million within the the fresh money geared towards boosting monetary supply to have forcibly displaced Ukrainians Bucks Alabama loans and you may mini, smaller than average medium dimensions businesses inside Poland belonging to FDPs, otherwise which might be including FDPs within their administration and you will staff.

Since 2011, the lending company could have been an element of the in the world Santander Class

Additionally, SPL’s money will specifically address female compelled to get-off Ukraine and you can women-owned smaller businesses, who will receive at the least 30 percent of the the brand new funds. Since the Russia’s invasion out of Ukraine, Poland have welcomed over step one.eight mil Ukrainian FDPs, nearly 50 % of whom discovered employment, and you will Ukrainians entered near to 30,000 brand new enterprises in the Poland.

The capital includes a synthetic exposure import (SRT) purchase in which IFC will bring a pledge so you’re able to SPL into the a percentage of their qualified personal loan portfolio

“Due to the guarantee, we are able to discharge investment which means develop credit to Ukrainian retail and you may SME consumers inside Poland. We’re happy that is an additional effort with the IFC which enables us to bring actually stronger service into development of the Shine cost savings,” said Maciej Reluga, Management Panel Representative in the SPL.

It scratches IFC’s very first money to increase economic introduction to own Ukrainian FDPs, as well as IFC’s basic SRT aimed at help FDPs internationally.

“IFC is still a robust recommend of Ukrainian someone, whether they seek to rebuild its existence and you may enterprises in their domestic nation otherwise have been forced to take action someplace else,” told you Alfonso Garcia Mora, IFC’s Vp for Europe, Latin America and Caribbean. “With this groundbreaking financing, we try to generate significantly more capital available to forcibly displaced Ukrainians and you can service their enterprising activities within the Poland.”

IFC has actually an incredibly effective reputation impactful investments with SPL, that’s a person in Santander Classification. IFC’s venture having SPL once the 2016 includes a beneficial 150 billion loan to have SPL’s leasing part dedicated to financial support feminine entrepreneurs, the original subordinated eco-friendly thread from inside the Poland totaling $150 mil, additionally the earliest SRT business when you look at the growing avenues with an environment chance mitigation objective.

Artificially displaced people suggest those who have become forced otherwise obliged to escape or get-off their houses otherwise places out of habitual home (if within their very own nation otherwise across the an international border), down to, or even in purchase to eliminate, the results from equipped dispute, points away from generalized physical violence, violations off person liberties, or absolute or peoples-generated catastrophes according to UNHCR.

Santander Financial Polska Classification is one of the premier monetary communities while the premier lender which have personal investment into the Poland. This has progressive monetary choices for individuals, mini, smaller than average average-measurements of enterprises and you may around the globe businesses. SBP has secure sources of financial support, a powerful funding and you may exchangeability feet and you can a great diversified investment portfolio. The bank is among the markets leaders regarding the have fun with of contemporary technology within the banking functions, continuously building the brand in accordance with the proper purpose off to get an informed financial into the consumer. Santander Bank Polska’s top priority is customer happiness and you can commitment. For this reason the bank continuously executes innovative functionalities that will to address personal finances and you may efficiently perform a friends.

]]>Taylor Milam-Samuel try your own financing writer and you may credentialed instructor who’s excited about enabling anyone control their profit and build an existence it love. When this woman is perhaps not comparing economic fine print, she can be found from the classroom exercises.

The newest Joined Characteristics Vehicle Connection (USAA) is a colorado-centered lender offering participants various financial products. In order to qualify, you should be an experienced, active-responsibility armed forces service member, or instant cherished one.

Subscription has of good use perks like access to insurance factors, traveling coupons, full-services banking, and fund. In spite of the positives, USAA not any longer offers figuratively speaking.

Why doesn’t USAA offer college loans?

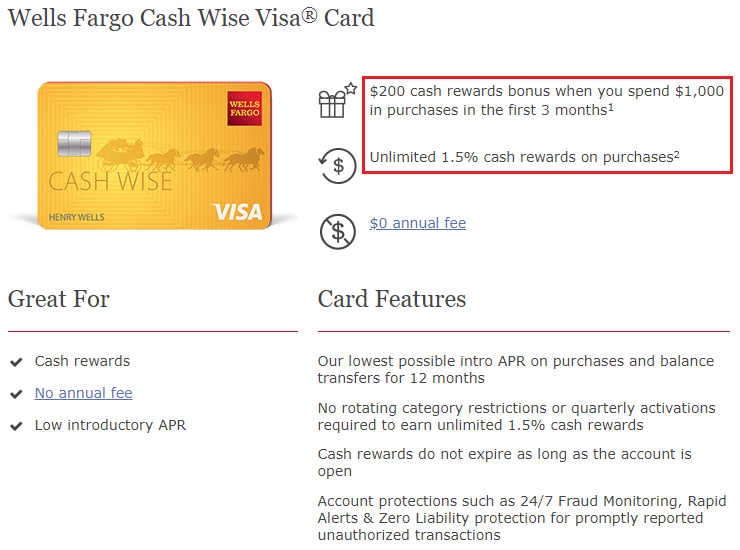

USAA not also provides student education loans. Inside 2017, the organization discontinued its connection that have Wells Fargo, and therefore welcome they so you can matter individual college loans to help you qualified professionals having good 0.25% disregard. Of a lot players are now trying to find selection.

When you have a beneficial USAA student loan for the payment, the termination of the connection will not impact you. You can preserve settling the loan because the prepared. But if you might be an effective USAA affiliate selecting an educatonal loan, thought other available choices.

There are two brand of student education loans: federal financing and personal money. Before 2017, USAA offered individual college loans, taking flexible capital for educational costs.

Individual figuratively speaking are around for mothers and students which be considered. Pricing and you can words confidence your credit payday loans Underwood Petersville score, amount borrowed, or any other products.

As you search for choice creditors, consider these five lenders, as well as that especially for military participants in addition to their family.

Navy Government Borrowing Union: Good for military borrowers

- Members-only credit connection on armed forces neighborhood

- Consumers cannot pause costs through the university

- Consumers is also need Navy Federal’s Occupation Recommendations Applications, and additionally an application builder

Getting army members, a student-based loan out of Navy Federal Borrowing from the bank Partnership is the most similar choice to a USAA mortgage. Instance USAA, Navy Government was a members-just credit union one to serves the army people throughout fifty says. The business now offers a simple on line application processes to have undergraduate and you may scholar money, there are no costs.

You must be an associate to try to get a loan. Becoming entitled to registration, you need to be a working, retired, seasoned provider affiliate or a direct relative. Institution from Cover (DoD) civilians also can be participants.

Cosigners are not necessary, however, many scholar consumers will need (or wanted) to incorporate you to qualify for most readily useful financing conditions. Navy Government prices nine out-of ten education loan people features an excellent cosigner.

Navy Government needs borrowers and then make attract-just or $25 monthly installments at school. The fresh new cost term is actually a decade. not, Navy Government does not fees a prepayment penalty, and you will consult a great cosigner launch after 24 months of consecutive repayments.

College Ave: Better complete

- Comprehensive loan choices, in addition to undergraduate, scholar, moms and dads, and you will industry knowledge

- Choose your own payment label

- Money for as much as 100% of knowledge costs

College or university Ave even offers college loans to help you undergraduates, graduates, and mothers. The financial institution now offers funds for community education applications. The fresh new fund is mask to help you 100% off academic costs, along with university fees, courses, and you can place and you may panel.

The lender even offers five repayment term choice-five, seven, 10, otherwise fifteen years. Borrowers can put-off money up until just after school or select one from around three within the-college or university repayment plans. Extremely consumers need good cosigner getting qualified. Immediately after completing more than half of the brand new planned fees several months, you can request a cosigner launch.

There are no application, origination, otherwise prepayment charges, and consumers could possibly get a 0.25% Apr write off to possess establishing automated costs. While the company offers aggressive pricing and you can words, it will not has actually particular advantages to services players.

]]>Mortgage payments can decrease over the years if you are paying out-of personal financial insurance policies or refinancing the loan in the less speed, whereas lease costs could potentially boost at each and every rent renewal

SEATTLE , /PRNewswire/ — New month-to-month cost of homeownership are much more possible than just anybody imagine. According to yet another Zillow Home loans study 1 , a month-to-month mortgage repayment is largely cheaper than rent for the twenty two of fifty premier You.S. metros. Recent dips from inside the home loan cost, having fallen on the low level as the very early 2023, keeps somewhat less monthly premiums.

New Orleans , il and you may Pittsburgh supply the greatest offers when you compare the price regarding lease in order to home financing percentage, ahead of taxes and insurance coverage, and you will while a buyer can also be place 20% off. For those who can also be developed an advance payment, to find property in these places could be the correct move.

Zillow Domestic Loans’ the new BuyAbility device is a simple treatment for know if homeownership is during visited, and if one may safe a home loan one to costs smaller than just lease

Within the Chi town , the typical rent payment was $2,074 30 days, but a monthly mortgage repayment 2 are $1,640 – a cost savings away from $434 a month because of the purchasing rather than leasing. During the The latest Orleans , residents also can save almost $450 thirty days spending a mortgage in place of leasing, and also in Pittsburgh , the fresh savings are about $320 a month. These types of deals is actually much more shocking with regards to you to definitely belongings to have product sales are bigger than the typical leasing.

So it pattern as well as is true over the U.S. The typical lease payment nationally try $dos,063 a month, nevertheless the typical homeloan payment is actually $step 1,827 – a savings away from $236 thirty days by the possessing rather than leasing.

“That it investigation reveals homeownership is alot more close at hand than most renters think,” said Zillow Home loans Elderly Economist Orphe Divounguy. “Discovering new advance payment continues to be a large hindrance, however for individuals who helps it be performs, homeownership may come that have all the way down month-to-month can cost you together with capability to make much time-title wide range in the form of family guarantee – something you miss out on due to the fact an occupant. With home loan costs shedding, its a good time to see just how their affordability has evolved incase it creates far more experience to acquire than just lease.”

Past month-to-month lease otherwise mortgage payments, you’ll find even more costs for both renting and you may homeownership that have to meet the requirements. Home owners spend fees, insurance rates, and you can resources each month, and must be ready for lingering repairs will cost you. Tenants bad credit personal loans Utah including generally speaking you would like insurance policies, and will commonly spend a lot more for vehicle parking, dogs, and you may utilities.

You’ll find benefits and drawbacks to help you both to shop for and leasing, but essentially, brand new extended you plan in which to stay your home, the greater amount of economic experience it will make to find. Past that, mortgage payments build homeowners’ guarantee in their house – expanding the economic share in their home eventually.

Rent growth has come down regarding pandemic-time levels and you can returned to enough time-work with norms, however, prices are still hiking. An average lease is 3.4% costly than just last year and nearly 34% more pricey than ever new pandemic. This new for-sales field, on top of that, offers possibilities getting consumers going into the fall, with well over one in 4 suppliers reducing costs. Having catalog upwards twenty-two% compared to last year, customers was putting on negotiating energy.

One simple way for consumers to find out if the prospective financial commission are less expensive than their lease is to apply BuyAbility, another type of tool from Zillow Mortgage brokers. BuyAbility quickly brings possible homebuyers a sense of how much capable afford and their probability of providing pre-acknowledged for home financing. People can register having BuyAbility frequently to your Mortgage brokers tab towards the Zillow’s application to see exactly how its estimate alter that have latest financial prices otherwise a change to its credit score.

]]>Retirement try a proper-deserved stage out-of life, and also for of a lot the elderly, homeownership represents a critical part of its net really worth. Anyway, the fresh new uptick in home beliefs over the last long time – hence resulted, inside the highest area, out of a combination of lower-interest levels, minimal domestic index and flooding home values within the pandemic – has remaining the average resident that have nearly $200,000 within the tappable home security . And if you are a good retiree the master of your residence outright – or try alongside expenses it well – you have got substantially more household collateral nowadays.

But what are you willing to would along with your house’s security ? Really, one monetary equipment that can easily be smartly employed during the later years try a home guarantee loan . Once you borrow on their residence’s security with a house guarantee mortgage, you are credit currency contrary to the portion of the home you have paid back off. And you will, oftentimes, you’re credit those funds on a reduced price than simply you might rating which have credit cards otherwise consumer loan.

And, because of the leverage this new collateral of your property using your senior years, you need the cash to enhance retirement lifetime or carry out unexpected expenses, or for virtually any quantity of uses. However, as with any types of monetary equipment, you will find several smart suggests – and several perhaps not-so-great ways – to utilize the residence’s equity. So what are some of the most strategic uses of a good domestic guarantee loan when you’re resigned? That’s what we shall fall apart less than.

In order to supplement your revenue

For almost all older people, one of the primary challenges during senior years try handling a fixed money . Societal Defense and your retirement money may not often be adequate to coverage the desired lifestyle, traveling preparations or unexpected scientific expenditures. However, playing with a home collateral loan so you can enhance your income can render an established source of funds.

And you can, you really have a couple options to believe whenever making use of your home equity. According to your needs and you may goals, you might go for possibly a house security line of credit (HELOC) or property security loan for a lump sum payment from dollars. Either choice are specifically good for retired people exactly who individual the belongings downright and want to open the benefits tied within the their property.

However, it is imperative to very carefully bundle and evaluate your capability to settle the mortgage in advance of borrowing from the bank, due to the fact neglecting to get it done you will definitely put your family on the line. It’s also wise to be sure to influence appropriate total obtain and you may understand the possible effect on your overall economic visualize.

To redesign or retrofit your house

Because you many years, it’s preferred to stand versatility and you may protection pressures of your home. However, investing family home improvements or retrofitting produces their way of living space much warmer and you will obtainable throughout the old-age. Should it be incorporating an excellent ramp, expanding doors, starting grab bars or remodeling the restroom, this type of advancements can be somewhat increase standard of living.

Using property equity loan for these modifications might be good very wise choice, whilst enables you to ages in place while keeping the property value your residence. Try to prioritize programs that target your specific demands and you can fall into line together with your enough time-label goals. Consulting with a company and a work-related specialist can help you choose the most effective variations for the unique condition.

To help you consolidate high-desire debt

Certain retirees will find on their own strained with a high-appeal financial obligation from credit cards, scientific expenses and other loans. Consolidating such expense with a property equity mortgage might be an excellent proper proceed to make clear your finances and relieve full desire money. That’s because house security fund usually offer lower interest levels compared to playing cards or unsecured loans, probably saving you profit the long term.

not, it’s vital to strategy debt consolidation reduction with caution and abuse. After you have repaid your highest-focus debts, try to avoid racking up brand new ones and concentrate into dealing with your finances prudently. It helps to consult with an economic mentor to help make a strategy that aligns along with your senior years desires and you can guarantees your can conveniently repay the house equity mortgage.

To cover studies or offer assist with nearest and dearest

Of numerous retirees need certainly to assist assistance their youngsters or grandchildren when you look at the gaining the educational goals. And, a property guarantee loan can be a feasible choice to finance education costs , whether it is coating university fees costs, permitting having figuratively speaking otherwise assisting in to shop for a house. That it strategic entry to household collateral is also sign up to the family’s monetary really-are and construct a long-lasting legacy.

In advance of continuing, even if, make sure you discuss your own intentions that have family relations and establish obvious criterion away from cost or any possible affect their economic liberty. So it assures everyone in it is on the same webpage and hinders people frustration later.

To help you broaden the investment

Smart old-age thought is sold with managing and you americash loans Piedra may optimizing your investment profile. And you will, playing with property security mortgage so you can diversify your own expenditures with holds, bonds or any other money-promoting property might be a strategic flow, specifically if you greeting highest yields versus interest you might be purchasing to your financing.

Yet not, this plan involves risks, and you may business movement may affect your own output. It’s crucial to carefully research and you can assess potential investment, given your own chance threshold and you may financial requires. Diversification must also fit your overall retirement approach rather than establish way too many financial instability.

The bottom line

Property equity mortgage are a very important product having retirees when used strategically. Regardless if you are seeking to enhance your revenue, generate renovations, consolidate loans, support family relations otherwise broaden expenditures, cautious think is very important. However, by leveraging the latest security of your house intelligently, you can increase retirement ages and probably guarantee a more economically safer future.

Angelica Leicht was senior editor to possess Dealing with Your bank account, in which she produces and you can edits articles for the a selection of personal funds topics. Angelica previously stored modifying opportunities at Easy Dollar, Interest, HousingWire or other financial publications.

]]>